Get the free first b notice template form

Show details

Do you need the court to order the other parent to do a DNA test No Yes. If yes you will need to file a Motion for DNA Testing with this Complaint. You can get motion forms at www. courts. alaska.gov/shcforms. htm shc-pac6. Custody and Visitation The court decides custody and visitation issues by figuring out what is in the children s best interests. For links to many school calendars visit www. courts. alaska.gov/shc/calendars. pdf. For a one-pa...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your first b notice template form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your first b notice template form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit first b notice template online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form first b notice. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

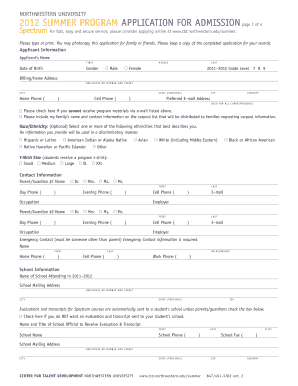

How to fill out first b notice template

How to fill out form first b notice:

01

Obtain the form: You can usually find the form first b notice on the website of the Internal Revenue Service (IRS).

02

Fill in the details: Provide the necessary information requested on the form, including your name, address, and tax identification number.

03

Describe the debt: Clearly explain the details of the debt that is owed to you, including the amount and when it was incurred.

04

Attach supporting documents: If you have any documents that support your claim, such as invoices or contracts, make sure to include them with the form.

05

Send the notice: Once you have completed the form, make copies for your records and send it to the appropriate recipient, which is usually the debtor.

Who needs form first b notice:

01

Creditors: Creditors who are owed money by a debtor can use the form first b notice to formally notify the debtor of the debt and request payment.

02

The Internal Revenue Service (IRS): The IRS may request a form first b notice from a creditor as part of their collections process for certain types of tax liabilities.

03

Debtors: Debtors who receive a form first b notice need to be aware that they have an outstanding debt and should take action to either dispute the debt or arrange repayment.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form first b notice?

Form First B Notice is a notification sent by the IRS to inform a taxpayer that the payee's taxpayer identification number (TIN) provided on Form 1099 is incorrect or missing. This notice is usually sent to payers (employers or businesses) to alert them about the errors in the TIN provided by the payee (employee or individual).

The purpose of the Form First B Notice is to give the payee an opportunity to correct the information and provide the correct TIN to the payer. The payer is required to provide the payee with a copy of the notice and the payee must respond within a specific timeframe (usually 15 days) by completing and returning Form W-9 to the payer.

If the payee fails to provide the correct TIN or does not respond to the notice, the payer may be required to begin backup withholding on future payments made to the payee.

It is important for both payers and payees to promptly address and rectify any issues related to TIN errors, as it can have financial and reporting implications for both parties.

Who is required to file form first b notice?

The employer is required to file Form First B Notice.

How to fill out form first b notice?

To fill out a Form 1st B Notice, follow these steps:

1. Gather the necessary information: You will need the employee's information, including their name, social security number (SSN), and current address. Make sure you have their correct SSN to avoid any mistakes.

2. Verify the information: Double-check the employee's details to ensure accuracy. If there are any mistakes or discrepancies, it's important to correct them before proceeding.

3. Complete the top part of the form: Enter your contact information in the designated boxes, including your name, title, business name, address, and telephone number. You may also need to provide your fax number and email address, although these are optional.

4. Provide employee information: Fill out each section dedicated to the employee in question. This includes their name, SSN, and address. If there are any aliases or alternative names used by the employee, provide them as well.

5. Select the appropriate checkbox: The Form 1st B Notice contains several checkboxes that indicate the reason for issuing the notice. Choose the checkbox that accurately represents the reason for the notice. For example, if the employee's name or SSN provided do not match IRS records, choose the corresponding checkbox.

6. Enter the payee's name and taxpayer identification number: If the employer is different from the payee, provide the employer's name and taxpayer identification number (TIN). This information can usually be found on previous tax forms or employee documentation.

7. Sign and date the notice: Once you have completed all the necessary sections, sign and date the notice as the payer or authorized representative of the payer. Make sure to date it with the current date.

8. Send the notice: Keep a copy of the completed Form 1st B Notice for your records and then send the original to the employee. It is typically sent via certified mail with a return receipt request to ensure proof of delivery.

Remember, if you have any doubts or need further clarification, consult with a tax professional or refer to the IRS instructions for Form 1st B Notice (also known as IRS Letter 972CG).

What is the purpose of form first b notice?

The purpose of a Form First B Notice is to notify a payee that their name and taxpayer identification number (TIN) combination does not match the Internal Revenue Service's (IRS) records. This notice is typically sent by businesses or organizations that make payments, such as wages or non-employee compensation, to individuals or entities. The recipient is required to review the notice and take necessary steps to correct any discrepancies to ensure accurate income reporting and tax compliance.

What information must be reported on form first b notice?

Form 1-9, also known as the First Notice of Injury or Illness, is a form used to report workplace injuries and illnesses to the employer's workers' compensation insurance carrier. The information that must be reported on this form includes:

1. Employee information: Name, address, social security number, and occupation of the injured/ill employee.

2. Employer information: Name, address, and contact details of the employer.

3. Description of injury or illness: A detailed explanation of the work-related injury or illness, including the date, time, and location of the incident.

4. Witnesses: Information about any witnesses to the incident, if applicable.

5. Medical treatment: Details about the medical treatment the employee received for the injury or illness, including the name and address of the healthcare provider.

6. Lost wages: Information about any lost wages or time off work as a result of the injury or illness.

7. Insurance information: The name, address, and policy number of the employer's workers' compensation insurance carrier.

8. Signature: The injured/ill employee's signature certifying the accuracy of the information provided.

It's important to note that specific requirements and information may vary by state, so it's crucial to consult with the appropriate state workers' compensation agency or an attorney for the most accurate and up-to-date information.

When is the deadline to file form first b notice in 2023?

I apologize, but I'm unable to provide specific information about the deadline to file a "Form First B Notice" in 2023. The deadline may vary depending on the specific circumstances and jurisdiction. It's essential to consult the official IRS documentation or contact a tax professional for the most accurate and up-to-date information regarding tax form deadlines.

What is the penalty for the late filing of form first b notice?

The penalty for the late filing of Form 1st B Notice (CP2100 or CP2100A) can vary depending on several factors, including the number of payees involved and the amount of time the form is filed after the due date. As of 2021, the penalty rates are as follows:

- $50 per late Form 1st B notice if filed within 30 days after the due date

- $110 per late Form 1st B notice if filed more than 30 days after the due date, but before August 1st

- $280 per late Form 1st B notice if filed on or after August 1st

These penalties are subject to change and may be adjusted annually by the IRS. Additionally, penalties can be higher if there is intentional disregard or if the forms are not filed electronically as required. It is recommended to refer to the latest IRS guidelines or consult a tax professional for accurate and up-to-date penalty information.

How do I make changes in first b notice template?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your form first b notice and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I create an electronic signature for the first b notice template in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your form first b notice in minutes.

Can I create an electronic signature for signing my first b notice template in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your form first b notice right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

Fill out your first b notice template online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.